Long Term Care Benefit through Chubb

You may have heard about the rising costs of long term care. It's a serious issue, and unless you've been through it, you might not realize how financially overwhelming it can be.

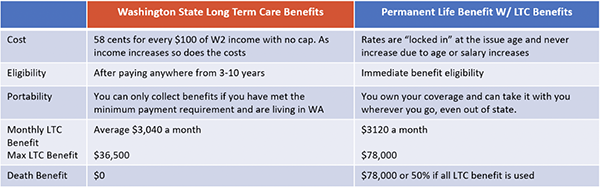

That's why the State of Washington is administering a state-provided long term care benefit funded via a new payroll tax, starting Jan 1, 2022.

The tax applies to all W-2 employees working in WA state. You will pay 58 cents of every $100 of W-2 income.* Take your annual salary and multiply by 0.0058 to calculate. (A person earning $40,000 per year would pay an annual tax of $232.)

*(tax can increase every 2 years)

WFSE has another option.

WFSE/AFSCME Council 28 is working with NW Benefit Advisors to provide members with the affordable option to purchase a permanent life benefit with long term care. This plan provides a long term care benefit funded by life insurance, so you get two benefits in one. Even if you use the long term care benefits, you will still have a death benefit. If you never use the long term care benefit, you still have a death benefit available. This benefit provides you with flexibility and choices. You can select a benefit amount that works for you and keep your coverage if you move, change jobs, or retire. You also get locked in rates that don't go up due to age or salary.

Consider this alternative.

If you get your own long term care coverage before Nov. 1st, you can apply for an exemption from the new payroll tax.

You must take action to determine what is right for you! The deadline to enroll in this benefit is Sept. 30th.

How to get started

- First, attend a Zoom session on any of the following Wednesdays from 12-1 p.m. or from 6-7 p.m.

August 25

September 1

September 8

September 15

September 22

September 29

Zoom Link:https://zoom.us/j/95273340741?pwd=UTY3UU1kUHMyVFJMb0p0bzhDa2NiZz09

Phone: 253-215-8782

Webinar ID: 952 7334 0741

Password: 221930 - Next, view the LTC siteand schedule an appointment to discuss your options with Chubb.

- To enroll in Chubb, you must do so by September 30.