Taxpayer Protection Act introduced

Taxpayer Protection Act hits home in wake of damning audit report on outsourcing

AFSCME Council 28 (WFSE) Taxpayer Protection Act may be needed now more than ever just days after a legislative audit report questioned the value of outsourcing state work in the agency charged with managing many business and operational services in state government.

The Joint Legislative Audit and Review Committee (JLARC) on Jan. 4 issued a damning report on the six-year track record of contracting out by the Department of Enterprise Services. READ REPORT HERE

JLARC said it’s unclear that the outsourcing of web design and maintenance and bulk printing “saved the state money or improved service delivery performance.”

The JLARC study indicates poor oversight and accountability – even as DES currently has two other contracting-out pilot projects underway.

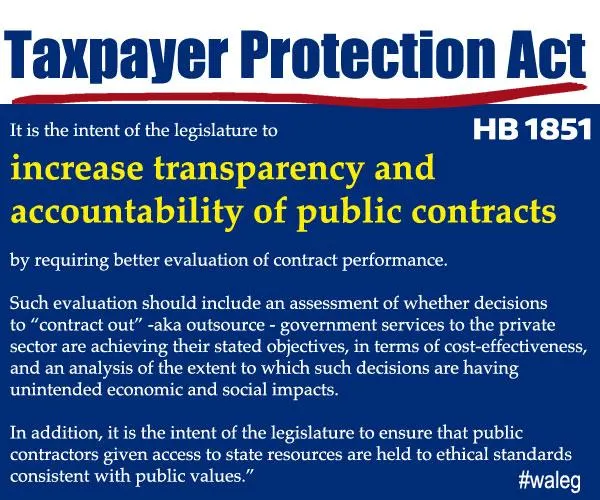

Enter the AFSCME Council 28 (WFSE)-initiated Taxpayer Protection Act (ESHB 1851) that a bipartisan group of legislators revised in the interim for a compromise that’s back again this year. The bipartisan effort makes sense because the state actually contracts for more goods and services than it actually provides directly.

The Taxpayer Protection Act would increase transparency and accountability for dollars spent on government contracts. It would increase the evaluation of costs, require more robust contract monitoring and mandate contract close-out procedures and reports.

It came before the House State Government, Elections and IT Committee Wednesday (Jan. 10), where sponsor Rep. Laurie Dolan of the 22nd Dist. said the new, improved bill provides a “thoughtful process in order to protect taxpayer resources.”

AFSCME Council 28 (WFSE) echoed its members’ concerns by again urging passage of the Taxpayer Protection Act.

“We believe that Washington can improve on its practices,” said Alia Griffing, the AFSCME Council 28 (WFSE) Research and policy Director.

She explained that the bill grew out of members’ frustration “where their work goes out the door – and then they have to come back and fix” contractors’ screw-ups.

The greater accountability and transparency didn’t set well with industry lobbyists. A lobbyist for general contractors said the bill “seems to be a barrier to contracting out.” An association of 150 engineering companies opposed the Taxpayer Protection Act outright.

That’s a shame, Griffing said.

“The overall goal is that taxpayers should know how their money is being spent and to ensure that we’re getting the most bang for the buck,” Griffing said.

Follow this bill at WFSE.org/1851